Stock Investing For Dummies: Disregard Fear and Focus on the Trend

Updated May 21, 2024

Every disaster is nothing but opportunity knocking in disguise. Most slam the door on it instead of embracing it with a warm hug. Sol Palha

Never listen to the Media; we will discuss this further in the article. We want to address a request several readers put forth recently. They asked us to create a Stock Investing For Dummies guide, so here goes. At some point in the future, we will look into creating a Stock Investing For Dummies downloadable guide in PDF format, but this page will have to suffice for now.

We will cover some of the most common stock investment mistakes egregiously committed by novice investors and even, sometimes, by so-called professional investors. Novice market players confuse the term stock market trading with stock market investing. Then you have investors who confuse the term long-term investing with the concept of buy and hold; there is nothing one should buy and hold forever if you do so, the idea should be called buy and fold. This is probably one of the most common investment mistakes of all time. There is a time to buy, a time to hold, and then a time to fold.

Stock Investing For Dummies Rule No 2.

The Investor looks for a trend and buys early in the direction; he/she then rides the trend until it ends. One should learn the basics of trend analysis as it will help one determine when a new trend is about to start. Now, let’s go back to the topic of Trading vs investing.

Stock market traders look for rapid, short-term gains; they prefer to extract the maximum profit from stock, options, future, etc. At least, that’s the concept behind trading. Unfortunately, most traders lose more than they win, and even when they do win, they usually make less than the long-term investor.

A few traders do exceptionally well; these chaps fall into the 2% category of overall players. Their gains are enormous, but for the rest of the players, a loss is all they can hope to look forward to. On the other hand, the investor looks for a new trend and usually tries to get in right at the beginning of the trend. If he/she is more aggressive, they try to get in when that particular market is putting in a bottom and has been trending sideways for some time, indicating that the worst is behind.

Stock Investing For Dummies Rule 3; Don’t confuse long Term with buy & hold

Another error often made is confusing long-term investing with the instead falsely promoted buy-and-hold policy. Long-term investing is getting in early and selling when the trend is over. A classic example was the Internet mania of the 1990s.

The time to buy was in 1995 and 1996, and the time to sell was in late 1999 and early 2000 when many Internet stocks started violating their main uptrend lines. Those who bought the buy-and-hold strategy found themselves even poorer than when they took initial positions in these stocks.

A more recent example was the housing bust and mortgage crisis that rocked the financial sector and produced a massive crash. The right time to get into housing was from 1999 to 2006. Yes, the Market did overshoot, but buying after 2006 was not a brilliant idea. From 2006 onwards, the intelligent player was selling into strength, such that by 2007 he virtually had no position in real estate.

Trend Analysis & Mass Psychology

We advised our subscribers to bail out long before the housing market topped out. The same holds for the internet bubble. On the same token, we got our subscribers into the commodity bull well before the market exploded. For example, we closed out our Silver positions for over 1000% in gains and Gold and Palladium positions for gains of over 700%.

We only refer to Bullion gains, not the increases we locked in many stock positions. We have now developed the most advanced tool we have ever developed, and this tool would have produced even more significant gains had we been in a position to use it earlier.

Stock Investing Tip

A fundamental concept one should learn when one seeks to enter the Stock Market is the art of being a contrarian. In short, a contrarian investor does something opposite to what the crowd is doing. The Tactical Investor has always been known for taking contrarian views based on Mass Psychology. In other words, the emphasis is on Mass Psychology as emotions drive the markets. Sometimes, even contrarians have a hard time digesting some of our views.

Portfolio management separates the stock market winners from the losers. It is one of the most important and neglected areas of investing. Many traders or investors who could have otherwise been successful lose year after year.

These standard stock investment mistakes could cost you a fortune, so take a little time to ensure you have a plan. It could distinguish between hitting the home run or losing your home.

Real Example: Unveiling Opportunities Amidst Pandemic-induced Hysteria

Would any of this be possible before the coronavirus pandemic? This hysteria was most likely created to provide the perfect backdrop where the Fed could inject as much as it wanted into the markets and drop rates to zero. This ultra-low rate environment will trigger share buyback programs of the likes we have never seen before.

Return to any bubble or market top, and always one element is present. The masses were in a state of ecstasy before the market plunged; even the tulip mania, where the mass media element was missing, ended on a note of euphoria. Without going further, we have to agree with some of the emails from subscribers who are long-term investors stating that this is a generational buying opportunity. The current sell-off in the markets is based on all suppositions and presumptions. This hysteria-based selling is creating a once-in-a-lifetime opportunity for the astute investor.

The media often presents theories without providing all necessary data, leading the public to treat opinions as facts. For instance, when searching for “Is the Coronavirus from the same family as the flu virus?” on Google, straightforward answers are scarce among the top results. Instead, articles emphasize the dangers of the new variant, overshadowing simpler explanations. According to the CDC, human coronaviruses are widespread, with seven known types, many causing common colds. However, MERS-CoV and SARS-CoV are associated with severe illnesses, as noted by Dr. Amesh A. Adalja from the Johns Hopkins Center for Health Security. This information is often buried under opinion-based articles from high-ranking media sites, making it difficult for the average person to find clear answers.

The media’s influence extends to investment behaviour, where fear of selling and herd mentality can lead to poor financial decisions. Fear selling occurs when investors react emotionally to market downturns, often resulting in significant losses. To combat this, investors should educate themselves about market volatility and the long-term nature of investment returns. Diversification across asset classes and sectors can mitigate individual investment risks, while a long-term perspective helps focus on investment goals rather than short-term market fluctuations. Regular portfolio reviews and professional guidance can also provide objective analysis and emotional support during volatile periods.

Contrarian investing, which involves taking positions against prevailing market trends, can be a successful strategy during market downturns. This approach is based on the belief that market sentiment often swings to extremes, creating opportunities for profit from eventual reversals. For example, during market crashes, asset prices often fall below their intrinsic values, providing buying opportunities for savvy investors. Historical data shows that markets recover over time, rewarding those who maintain a long-term perspective. Renowned investors like Warren Buffett and Sir John Templeton have successfully employed contrarian strategies, buying undervalued assets when others were selling in fear.

However, contrarian investing requires thorough research and a deep understanding of underlying assets. Investors must identify signs of market extremes, such as excessive optimism or pessimism, and conduct due diligence to find oversold or overbought assets. While this strategy carries risks, including potential short-term losses, disciplined investors who manage risk effectively can capitalize on market inefficiencies and achieve substantial long-term returns.

Father Of All Opportunities

We will finish tabulating all the sentiment data results tomorrow and send another update within 48 hours of gathering the data.

The 1987 crash and 2008 crash fell into the “mother of all buying opportunities” category, but we could get a setup that could blow these setups and create the “father of all opportunities“. Such an event is so rare that it might occur only once during an individual’s lifetime. In the short term, there is no denying the landscape looks like a massacre, but if one is going to focus solely on the short timelines, then the odds of banking huge profits are pretty slim.

The Imminent Market Shift: From Panic to Feeding Frenzy

Just 15 days ago, everyone would have begged for such prices, but 15 days later, everyone is ready to throw the towel in. The volatility is likely to continue until the end of the month, especially since V readings soared by a whopping 650 points to an all-time high. Again, think about it: when was the last time the Fed dropped rates by 150 basis points in two weeks? This is a massive development, but the current hysteria overshadows it. As stated before, companies will go ballistic with their share buyback programs.

When the panic subsides, it will create a feeding frenzy like we have never seen before. When you combine zero rates, two trillion dollar injections by the Feds, and several more billion-dollar packages designed to stimulate the economy, the result will be a market melting upwards. The markets will be driven to unimaginable heights by today’s standards. Zero rates will also force many individuals on a fixed income to speculate, and these guys have a lot of cash sitting on the sidelines.

The Crowd is in a state of disarray.

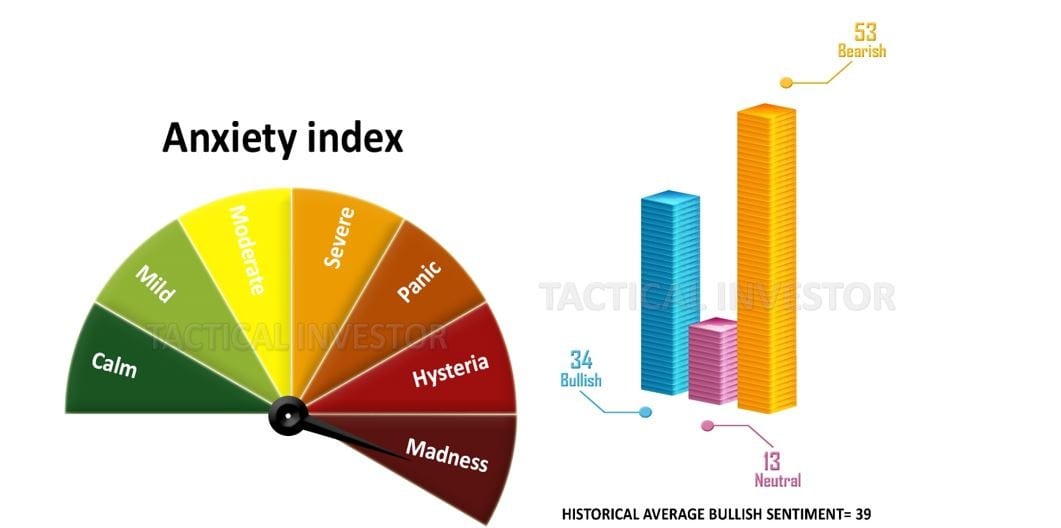

The masses are bullish and downright hysterical, and history has clearly illustrated that the best time to buy is when the crowd is in disarray. We are on the cusp of a generational buying opportunity; those who fail to act will live to regret this mistake for decades to come.

Elevate Your Stock Market Performance

A successful investment strategy involves a powerful blend of mass psychology and technical analysis. By understanding the crowd behaviour of market participants, one gains valuable insights into the market’s pulse. Market psychology plays a pivotal role in identifying trends; the rest becomes relatively straightforward once these trends are identified. Additionally, incorporating the fundamental principles of contrarian investing can elevate your trading skills, especially when combined with the crowd’s wisdom and technical analysis.

Lastly, maintaining a comprehensive trading journal is invaluable in gaining insights into your mindset and crafting a robust battle plan to confront any challenges.

Interesting Reads

Dogs Of The Dow Jones Industrial Average